-

You must be a Supporting Member to create a listing in the Long Range Hunting Marketplace. To read all the rules, click here.

We offer multiple options to become a Supporting Member here.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Paypal is now sending out 1099s after you pass $600 sales

- Thread starter kdrogers71775

- Start date

Help Support Long Range Hunting Forum

Help Support Long Range Hunting Forum

kdrogers71775

Well-Known Member

For gun sales you can Guntab. Actually, you can sell or buy as long as the other party is set up.

kdrogers71775

Well-Known Member

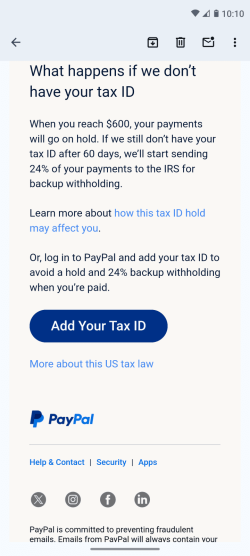

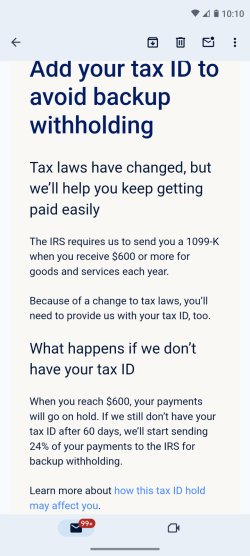

We are not business owners and dont even do alot of business on paypal. This is also TOTAL sales from what im reading, not $600 each sale. Because it says "once you reach $600"

Don't use "goods and services", use "friends and family" if you're not a merchant.

It's no differ than if you're a merchant/business owner. When you get a credit card processing machine you have to provide a tax id. PayPal is no different for merchant processing for "goods and services" is what they're basically telling you. If you're individual and processing a bunch of private party transactions as "goods and services" then you may have some issues I imagine. Good reason to contact a CPA.

Friends and Family transactions are not mentioned in the screen shot you sent.

It's no differ than if you're a merchant/business owner. When you get a credit card processing machine you have to provide a tax id. PayPal is no different for merchant processing for "goods and services" is what they're basically telling you. If you're individual and processing a bunch of private party transactions as "goods and services" then you may have some issues I imagine. Good reason to contact a CPA.

Friends and Family transactions are not mentioned in the screen shot you sent.

I used to use paypal. I have tried to migrate away from it to venmo. For a business, I would definitely stay away from it but for general classifieds it should be pretty easy to avoid paying taxes. As 2nd hand selling of items generally never get sold for profit in this industry.

I think a lot of people are missing a very important part of this. Yes, they may report the income but you get to report the expense side of things as well. You're taxed on net profit not total sales. 1099 will report total sales (@ PayPal anyways).

So, if you want to buy, sell, and trade a bunch of stuff and use PayPal (non F&F), start keeping your purchase receipts (yes, total pain). A lot of times, you're probably losing money on these transactions.

Example: You buy something for a $1,000 (Vortex Scope or what ever). Sell it on here for $900 and pay you shipping of $25 as part of the deal. You actually lost $125 (revenue minus expenses = $900 - $1,000 - $25.00 = -$125). Make it more fun, write off your milage to UPS/FedEx/USPS.

You will only get taxed on the full 1099 amount if you have zero receipts or expenses you can "prove." "Prove" is open to interpretation. You don't file your backup to the IRS but you'll need it if you get audited.

I know 98% of you are W2 employee's, so you don't worry about net profit (income minus expenses) and all that business accounting and tax stuff. If you own a business, you should be getting 1099's, probably issuing 1099's, and you should know all about them. If not.... You need a tax accountant, real bad.

Unfortunately, this could ultimately make your hobby a side business. If using PayPal with fee's vs. PayPal F&F.

You can pick and choose what transactions you accept PayPal for.

I am not a fan of this. Keeping paperwork and receipts for a hobby, I know I lose money on, is painful. Potentially, a bunch of extra record keeping.

The negative of not taking PayPal: You'll probably lose out of a large % or potential buyers. That'll more than likely lead to a lower selling price and it taking longer to sell.

So, if you want to buy, sell, and trade a bunch of stuff and use PayPal (non F&F), start keeping your purchase receipts (yes, total pain). A lot of times, you're probably losing money on these transactions.

Example: You buy something for a $1,000 (Vortex Scope or what ever). Sell it on here for $900 and pay you shipping of $25 as part of the deal. You actually lost $125 (revenue minus expenses = $900 - $1,000 - $25.00 = -$125). Make it more fun, write off your milage to UPS/FedEx/USPS.

You will only get taxed on the full 1099 amount if you have zero receipts or expenses you can "prove." "Prove" is open to interpretation. You don't file your backup to the IRS but you'll need it if you get audited.

I know 98% of you are W2 employee's, so you don't worry about net profit (income minus expenses) and all that business accounting and tax stuff. If you own a business, you should be getting 1099's, probably issuing 1099's, and you should know all about them. If not.... You need a tax accountant, real bad.

Unfortunately, this could ultimately make your hobby a side business. If using PayPal with fee's vs. PayPal F&F.

You can pick and choose what transactions you accept PayPal for.

- No receipts or backup = no PayPal w/ fee's.

- Have a receipt = use PayPal

I am not a fan of this. Keeping paperwork and receipts for a hobby, I know I lose money on, is painful. Potentially, a bunch of extra record keeping.

The negative of not taking PayPal: You'll probably lose out of a large % or potential buyers. That'll more than likely lead to a lower selling price and it taking longer to sell.

Venmo is owned by PayPal. Just an fyi.

Venmo is owned by PayPal.I used to use paypal. I have tried to migrate away from it to venmo. For a business, I would definitely stay away from it but for general classifieds it should be pretty easy to avoid paying taxes. As 2nd hand selling of items generally never get sold for profit in this industry.

Is venmo sending 1099s?Venmo is owned by PayPal. Just an fyi.

kdrogers71775

Well-Known Member

I think a lot of people are missing a very important part of this. Yes, they may report the income but you get to report the expense side of things as well. You're taxed on net profit not total sales. 1099 will report total sales (@ PayPal anyways).

So, if you want to buy, sell, and trade a bunch of stuff and use PayPal (non F&F), start keeping your purchase receipts (yes, total pain). A lot of times, you're probably losing money on these transactions.

Example: You buy something for a $1,000 (Vortex Scope or what ever). Sell it on here for $900 and pay you shipping of $25 as part of the deal. You actually lost $125 (revenue minus expenses = $900 - $1,000 - $25.00 = -$125). Make it more fun, write off your milage to UPS/FedEx/USPS.

You will only get taxed on the full 1099 amount if you have zero receipts or expenses you can "prove." "Prove" is open to interpretation. You don't file your backup to the IRS but you'll need it if you get audited.

I know 98% of you are W2 employee's, so you don't worry about net profit (income minus expenses) and all that business accounting and tax stuff.

Unfortunately, this could ultimately make your hobby a side business. If using PayPal with fee's vs. PayPal F&F.

You can pick and choose what transactions you accept PayPal for.

I am not a fan of this. Keeping paperwork and receipts for a hobby, I know I lose money on, is painful. Potentially, a bunch of extra record keeping.

The negative of not taking PayPal: You'll probably lose out of a large % or potential buyers. That'll more than likely lead to a lower selling price and it taking longer to sell.

I 100% agree.

I keep getting the "just use Friends and Family" stuff........Yes....i agree F&F are not affected by this. (YET)

However....Ive already stated severl messages ago that alot of folks on here and other venues will NOT use F&F. Thats what makes this a much bigger issue. If we all knew the guy we were buying/selling from then we would all use F&F. But we dont. And not everyone will. Which results in a large amount of sales being missed.

So, if you want to buy, sell, and trade a bunch of stuff and use PayPal (non F&F), start keeping your purchase receipts (yes, total pain). A lot of times, you're probably losing money on these transactions.

Example: You buy something for a $1,000 (Vortex Scope or what ever). Sell it on here for $900 and pay you shipping of $25 as part of the deal. You actually lost $125 (revenue minus expenses = $900 - $1,000 - $25.00 = -$125). Make it more fun, write off your milage to UPS/FedEx/USPS.

You will only get taxed on the full 1099 amount if you have zero receipts or expenses you can "prove." "Prove" is open to interpretation. You don't file your backup to the IRS but you'll need it if you get audited.

I know 98% of you are W2 employee's, so you don't worry about net profit (income minus expenses) and all that business accounting and tax stuff.

Unfortunately, this could ultimately make your hobby a side business. If using PayPal with fee's vs. PayPal F&F.

You can pick and choose what transactions you accept PayPal for.

- No receipts or backup = no PayPal w/ fee's.

- Have a receipt = use PayPal

I am not a fan of this. Keeping paperwork and receipts for a hobby, I know I lose money on, is painful. Potentially, a bunch of extra record keeping.

The negative of not taking PayPal: You'll probably lose out of a large % or potential buyers. That'll more than likely lead to a lower selling price and it taking longer to sell.

I 100% agree.

I keep getting the "just use Friends and Family" stuff........Yes....i agree F&F are not affected by this. (YET)

However....Ive already stated severl messages ago that alot of folks on here and other venues will NOT use F&F. Thats what makes this a much bigger issue. If we all knew the guy we were buying/selling from then we would all use F&F. But we dont. And not everyone will. Which results in a large amount of sales being missed.

kdrogers71775

Well-Known Member

And a "maybe yes, maybe no" on wether they will tax, fine, or pentalize you almost always ends up being a "yes"

Agreed. I get penalized every year by the IRS. I just try to minimize it to a tolerable level. LOLAnd a "maybe yes, maybe no" on wether they will tax, fine, or pentalize you almost always ends up being a "yes"

Similar threads

- Replies

- 0

- Views

- 2K

- Replies

- 24

- Views

- 1K

- Replies

- 3

- Views

- 2K